Data’s Edge: Manufacturer Activates R600M Extra Sales

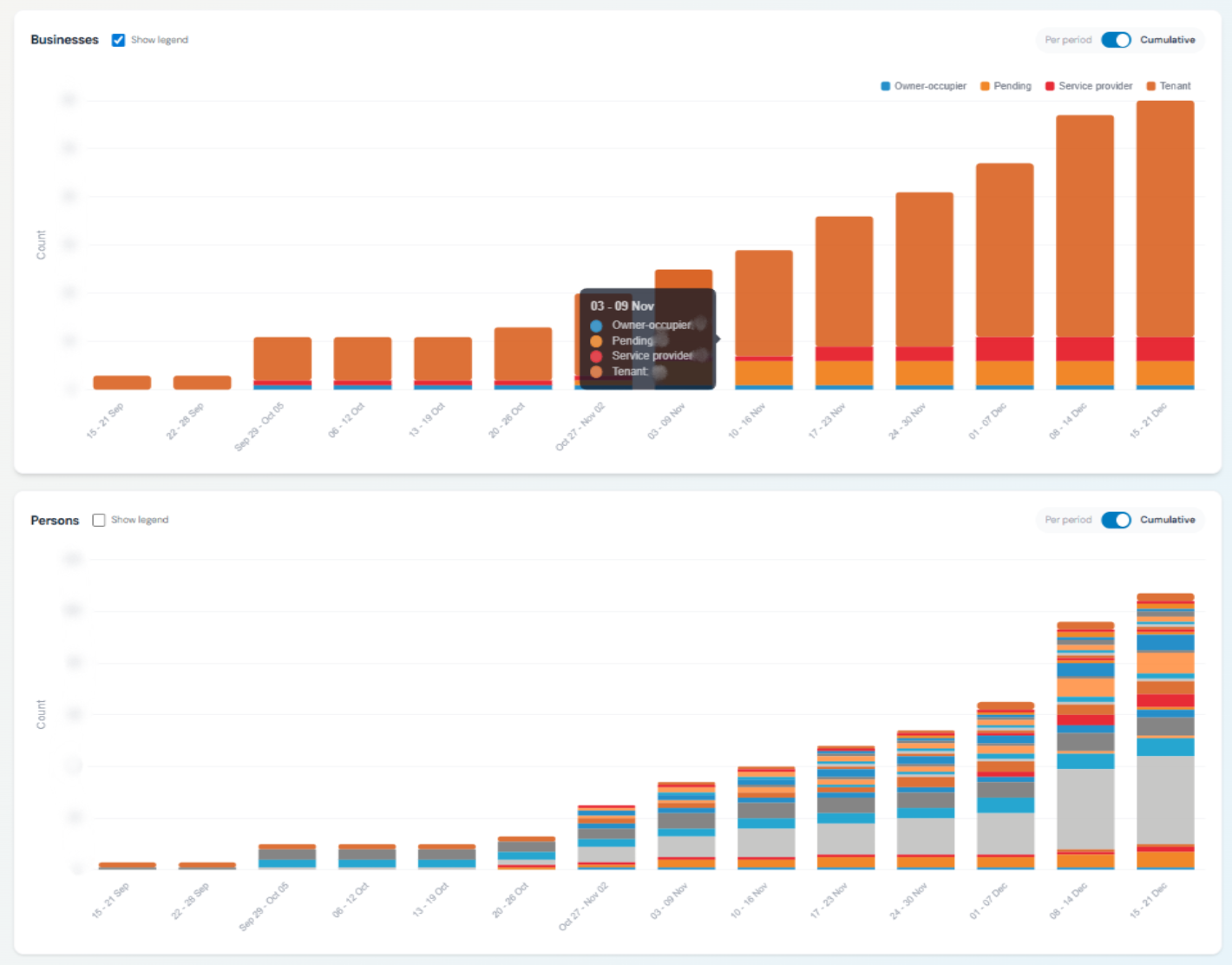

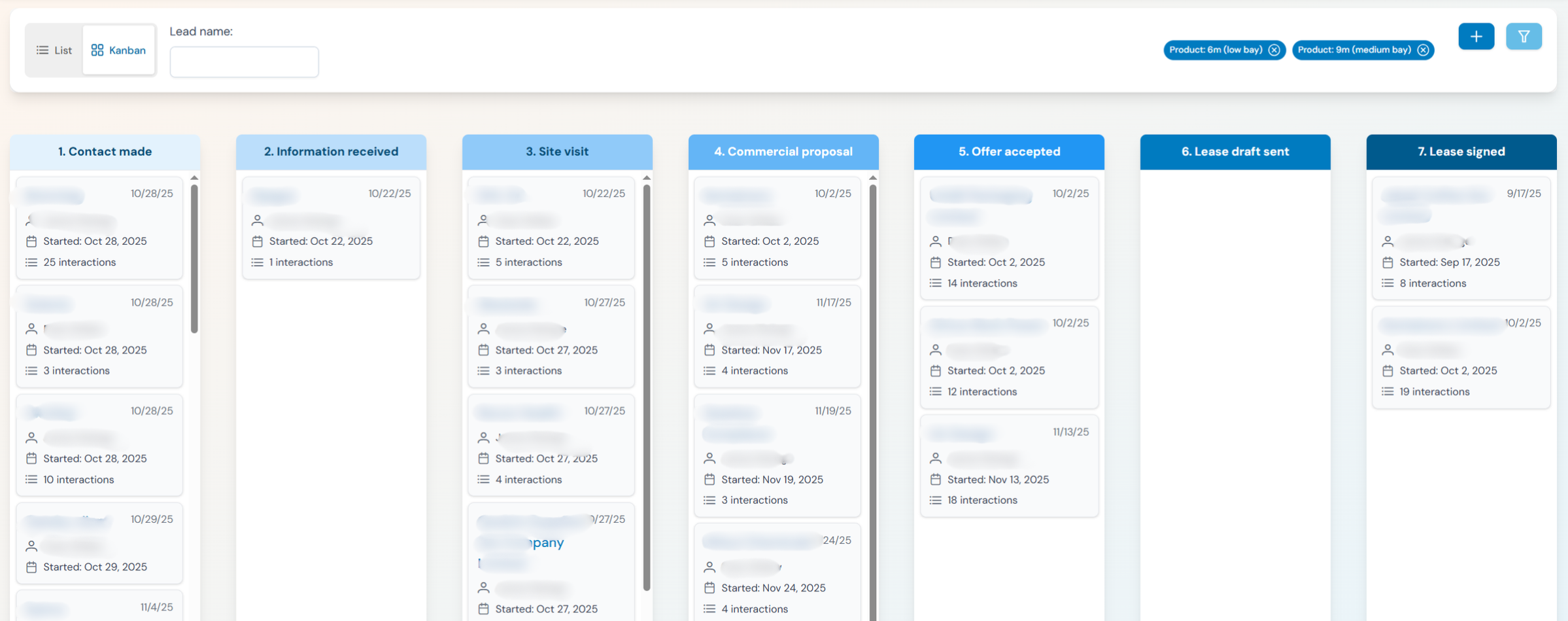

Data-driven decision-making is a buzzword. Here is a practical example. Using unique CRE data, a major South African manufacturer figured out their actual penetration, identified R600M in untapped office market revenues and picked up their customers were paying 33% more. Using this data, the business could plan a precise sales strategy, prioritising the best-returning segments.