The tech adoption lifecycle explains how the use of new products or innovation spreads.

(Clicking on the below image will enlarge it to a reading-friendly size)

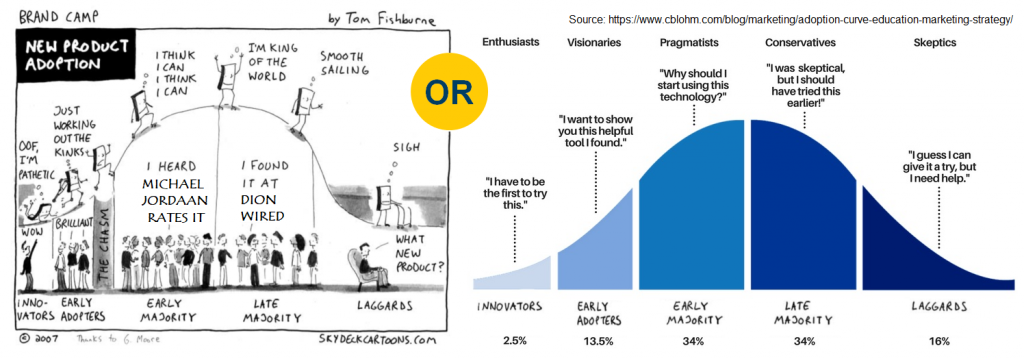

The above image unpacks your typical user types. It has been amended slightly for commercial property, and tweaked for Southern Africa.

Adoption happens from left to right – starting with the small minority of innovators on the left. According to the theory, use by each segment occurs strictly in sequence. A segment or adopter group will only adopt if used by the immediately previous segment. In other words, adoption doesn’t “leapfrog” or skip adopter groups.

The adopter groups are, in order: innovators –> early adopters –> early majority –> late majority –> laggards.

The bell-curved distribution means that the bulk of the users (early majority and late majority), an estimated c.70% of total users, exist in the “middle”.

History of the tech adoption lifecycle

Regis McKenna, the famous PR and marketing agency, responsible for the marketing successes of brands like Apple, Intel and Microsoft, was a big believer of the tech adoption lifecycle model. Out of interest, this model was first proposed by agricultural researchers in 1957 in Iowa. The model has been embraced by luminaries such as Geoffrey Moore and Clayton Christensen. For more information, please see Wikipedia’s excellent post here.

PMF and the tech adoption lifecycle

It would be negligent to not tie the tech adoption lifecycle to this seminal essay on product market fit (PMF), authored by Marc Andreessen, back in 2007. According to the theory, a product’s lifecycle can be categorised into two black and white periods: before PMF and after PMF. In simple terms, pre-PMF is hell, and post-PMF is success. (And “crossing the chasm” is that process of moving between the two)

The roles the user segments play: The bright sparks in the innovator and early adopter segments assist in steering the product to PMF. Once mature, the product is evangelised by these enthusiast and visionary personas. It is then embraced by the mainstream (early and late majority).

The tech adoption lifecycle model and CRE

The commercial real estate (CRE) industry is comprised of many verticals (e.g. brokerages / consultancies, property funds, analysts etc.). These verticals influence tech adoption by other verticals (and can activate network effects). Further, within these verticals, the tech diffusion model is in play too. Efficient distribution of new products within CRE is thus nuanced and requires a deep understanding of the industry ecosystem.

CRE is a highly complex, IP-dense industry. CRE professionals, having been burnt by industry outsiders who don’t have a) the domain IP, b) patient capital or c) time to deliver, are traditionally wary of data- and technology-driven innovation.

For more relevant information, this article explains:

- How enterprise SaaS (the vehicle that delivers innovation to CRE users) applies to the CRE industry, and further

- Why the CRE industry is starved of high quality technology.

The converse to this distribution model

Sharing hard-won learnings / offering some hopefully helpful advice:

When attempting to sell a new product, do proactively profile target customers. If that customer is not an innovator or early adopter, avoid engaging with that customer. Note: a useful “tell” of a (more conservative and risk averse) early or late majority customer: question/s like

“Which other companies are already using this product?”